SWIF Business Finance SBA Micro-Loan Program

Category: Business Finance Options

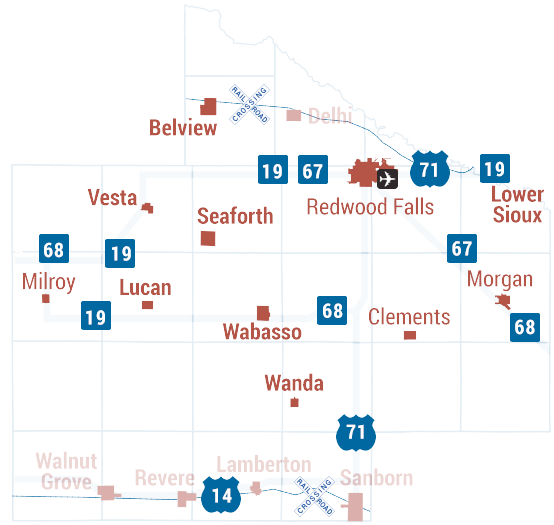

The Micro-Loan Program of the Southwest Minnesota Foundation (SWMF} was developed to provide loans to small local businesses. The creation of new jobs is a primary consideration in funding as long-term employment will enhance the region's ability to prosper.

Loan Criteria and Guidelines

1. Eligibility: Eligible businesses may be either start-up or expansion projects, and must be located within the eighteen county region served by SWMF. The type of businesses include, but are not limited to, those engaged in:

- Manufacturing

- Retail (must meet a critical community need)

- Service

- Daycare businesses

Loan funds are NOT available for the following activities or businesses:

- Agricultural production (crop or livestock)

- Debt refinancing/restructuring

- Companies relocating within Minnesota

- Loans to city or governmental units

- Development Corporations

- Projects which have other financing available

- Projects that cannot demonstrate a reasonable chance of success/repayment ability.

- Applicant must be a small business (five employees or less).

- Applicant must have a good personal credit history or an explanation of credit deficiencies.

- Project must have positive cash-flow projections based on reasonable income generation.

- Project must provide equal employment opportunities.

If business moves from the eighteen county region, note becomes due and must be repaid.

2. Loan Interest and Terms:

- Interest rate will be at prime plus 2%.

- Maximum SWMF micro-loan is $15,000

- Loan term shall be five years or less. Loans for leasehold improvements must be fully amortized within the life of the lease

- Loan Origination fee shall be 1% of loan amount, due upon loan closing Loans will be collateralized with first lien position whenever possible

- Borrower must sign a personal guaranty

- Borrower must have at least a 10% equity position or provide additional collateral to make up the difference

- Direct payment from borrower's bank account will be required (ACH)

- SWMF must be carried as a loss payee on property insurance

- Life insurance on the borrower may be required

- If not previously completed, borrower must attend and complete business management education, which may include a Small Business Management Course at a technical college, Fast-trac, or similar course. Funds for the education may be included in the loan proceeds.

3. Eligible Uses Of Loan Funds: All costs demonstrated as essential for the project, including working capital, inventory, machinery and equipment, and leasehold improvements are eligible for a loan.

- 4. Financing Gap: Loans can only be made to businesses that can substantiate a financing need due to the following conditions:

- Inadequate private lender financing

- Inability to pay market interest rates or term requirements

- Applicant must prove that the project cannot be funded without SWMF funds (bank denial letter or bank lending limit on project funds borrowed).

5. Business Planning: A business should have some expertise in or have assistance with product development, marketing and management. If assistance is needed, applicants can find support from available business development professionals such as regional development commission staff, community development personnel, or small business development consultants. Contact the SWMF if you are unsure about how to access these resources.

6. Application Procedure: Applicants are encouraged to call or visit the SWMF at an early stage in business development to discuss the feasibility of funding for their project.

Applicant must complete the Micro-Loan application (with personal financial statement), attach two years' business cash-flow projections, and provide the last two years' income tax returns - personal and business (if business applying has already been in existence).

7. Annual Reporting: After loan is made, annual financial reporting will be required in the form of an annual financial statement and income tax return.

.jpg)