Second Minnesota ethanol maker may shift to isobutanol

Wednesday, October 02, 2013

- Article by: DAVID SHAFFER , Star Tribune

- Updated: October 2, 2013 - 9:00 AM

Highwater Ethanol in Lamberton says it will install Butamax corn oil separation technology in what could be the first stage of a broader retrofit.

A Lamberton, Minn., ethanol plant is installing technology that could be the first step toward shifting production from ethanol to another biofuel called isobutanol.

Highwater Ethanol, which owns the plant, and Butamax Advanced Biofuels, a Wilmington, Del.-based company that developed the technology, announced the deal Wednesday and said they were negotiating a second-stage agreement to fully retrofit the plant in 2015.

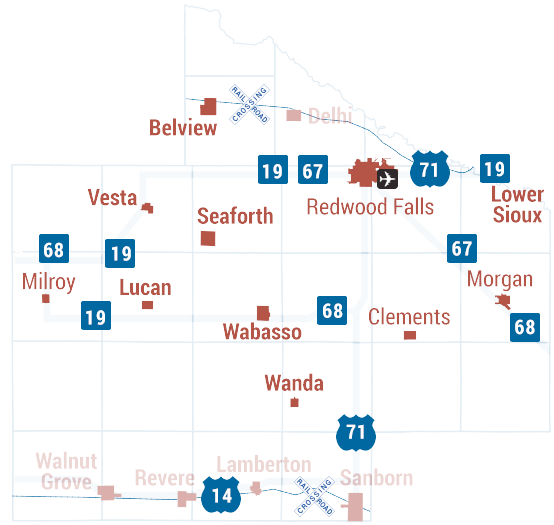

Under the licensing deal, Butamax will install its proprietary corn-oil separation technology in the Highwater plant, 40 miles west of New Ulm in southwest Minnesota. Financial terms were not disclosed.

Most ethanol producers have installed corn oil separation systems. They allow plants to extract a byproduct oil from corn mash that can be sold for use in animal feed or to make biodiesel. Highwater initially plans to employ the technology during ethanol production.

But the chief executives of Butamax and Highwater said the technology, which extracts corn oil at an early phase of production, also is a necessary step toward retooling the plant to produce isobutanol.

“It means a significant part of the retrofit is already done,” Butamax CEO Paul Beckwith said in an interview.

Highwater CEO Brian Kletscher, who announced two years ago that the plant was considering a shift to isobutanol, said he looks forward to the final stage of negotiations for isobutanol production.

“We are hopeful it will occur,” Kletscher said.

If Highwater eventually shifts production to isobutanol, it will be the second U.S. ethanol plant to do so. The other plant is in Luverne, Minn., owned by Englewood, Colo.-based Gevo Inc. That company and Butamax have separately bioengineered yeasts to produce isobutanol from corn.

Isobutanol is similar to ethanol in that it can be blended with gasoline as a motor fuel, but at a higher ratio without damaging engines.

“It has large advantages as a biofuel for refiners,” Beckwith said, including double the renewable energy credits. “Butanol is worth substantially more to a refiner than ethanol is.”

Gevo, which has been a major rival to Butamax, is initially marketing isobutanol for marine and jet fuel, and the U.S. military is testing it. Gevo also sees a high-value market in selling isobutanol as a chemical building block for bioplastics and other products now made with petroleum-derived isobutanol.

Butamax and Gevo remain locked in patent rights battle, with each company claiming partial victory. Meanwhile, Gevo has struggled with start-up problems at the Luverne plant that it retrofitted last year. The company has said it expects to reach full-scale processing this year.

In Highwater’s shift to isobutanol production, Butamax would be responsible for assuring its technology works, Beckwith said. Butamax, a joint venture of Dupont and BP, operates a pilot isobutanol plant in England. The Lamberton plant would be its first commercial-scale project.

Beckwith said he is confident the Butamax process is ready to be licensed.

“We are deploying technology that has been thoroughly tested,” he said.

Category: Agriculture, Renewable Energy

.jpg)